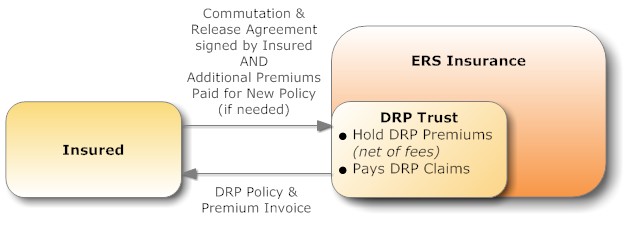

- After policy expiration, the Insured executes a “commutation and release” agreement. Remaining premium is calculated based on the overall performance of the policy.

- Funds stay in the trust to be used for policy renewal.

- Insured receives “Premium Vacation.”

- Tax neutral scenario:

- premiums “returned” are taxable;

- premiums “paid” are tax deductible.

Example:

$5,000,000 Year 1 DRP Premiums

$2,000,000 Year 1 Claim Payments

$3,000,000 Remaining in Trust when policy is commuted and released

$5,000,000 Year 2 DRP Premiums

$3,000,000 Premium Rollover from Year 1 (tax neutral)

$2,000,000 Premiums remitted for Year 2 (tax deductible)