Who Should Consider a PIC?

- Businesses in an insurance inadequate field

- Privately held family business

(all business types) - Highly compensated professionals

- Revenues over $5 million per year

- Businesses which are consistently profitable

Who can own the PIC?

- Individuals

- Trust(s)/FLP(s)

- LLC(s)

- Partnership(s)

- Corporation(s)

Common business types participating:

Construction, finance, energy, healthcare, retail, transportation, general contracting, professional athletes, and many more...

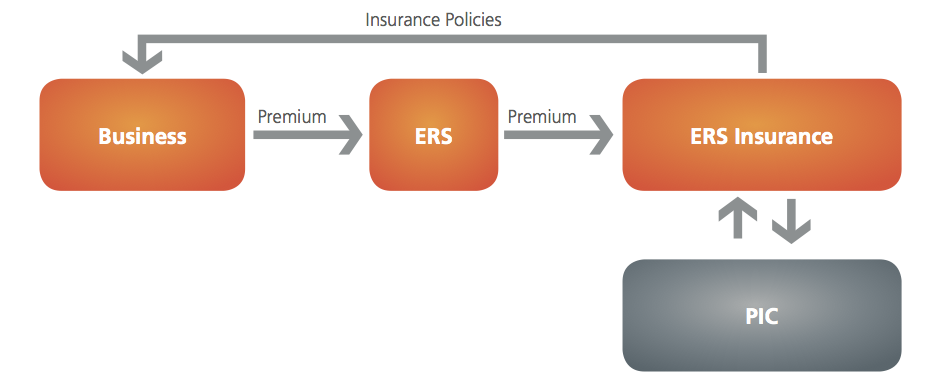

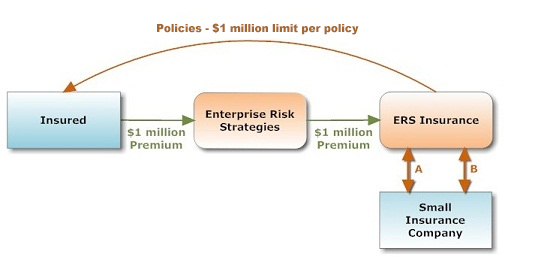

The PIC Structure: How the Numbers Work

An example of Private Insurance Company financial performance with annual premiums of $1 million.

Assumptions:

- ERS Insurance is a Utah PIC insurance company

- Premium is $1 million

- Policies - $1 million limit per policy

- Enterprise Risk Strategies is the PIC Manager for both ERS Insurance and PIC

How it works

- Insured pays premium to Enterprise Risk Strategies

- Enterprise Risk Strategies remits premium to ERS Insurance

- ERS Insurance issues policies to Insured with $1 million limit per policy

- ERS Insurance reinsures to PIC 1st layer of risk (first dollar through a set limit) [A]

- ERS Insurance places 2nd layer of risk (total limits net of 1st layer of risk) into reinsurance pool

- ERS Insurance cedes risk in reinsurance pool to PIC [B]